The firearms market declined significantly in June, continuing a years-long trend. So, where is the bottom?

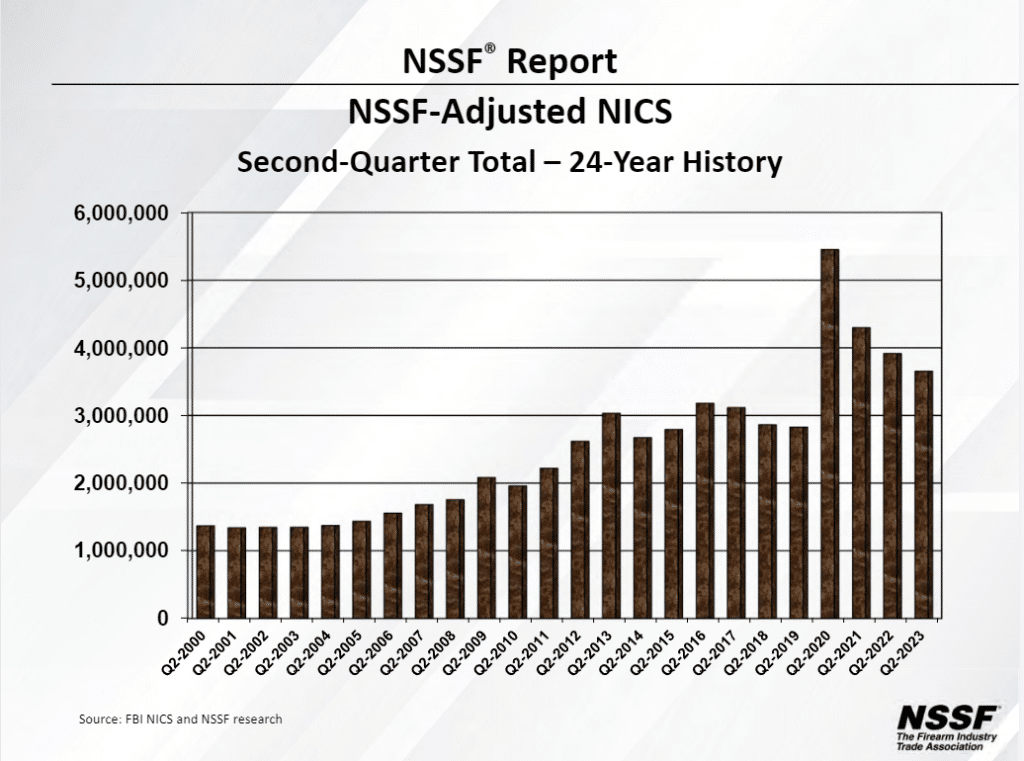

The National Shooting Sports Foundation’s (NSSF) analysis of FBI background check data for last month suggests the 1,110,696 sales it achieved is down nearly 20 percent from the previous June. It’s down almost 50 percent from the all-time June sales record of 2,177,586 set in 2020.

The decline is a bit less severe when looking at the entire second quarter, but it’s still there. The 3,654,134 sales from the second quarter of this year are down 6.7 percent from last year and 67 percent from 2020’s all-time high.

The decline from 2020’s unprecedented numbers should come as no surprise. That year, and especially that summer, provided a likely (hopefully!) once-in-a-generation mix of chaotic factors that drove people to seek out a means of self-protection. The onset of the coronavirus pandemic saw everything from prisoner releases to police sick days skyrocketing to meat shortages.

Then the murder of George Floyd by a Minneapolis police officer in May 2020 pushed society further over the edge and led to a toxic mix of elevated distrust in law enforcement and violent rioting. That moved gun sales in June 2020 to a point nobody could have expected, a jump that surpassed even March 2020 for percentage increase in demand.

As things began to settle back closer to normality, nobody expected gun sales to remain at the level they’d reached in the second quarter of 2020. The spike in gun sales was exactly that: a spike.

Since then, industry insiders and analysts alike have wondered where the new floor would be nailed down. The arrival of millions of new pandemic-era gun owners provides good reason for optimism. As NSSF’s Mark Oliva told The Reload this week, the conventional wisdom is that demand will settle in somewhere north of the pre-2020 peaks.

“What we typically see if we look at the historical pattern of it,” he said, “when we come off of those highs, and we hit that floor, that new floor is always higher than the ceiling was before.”

And there is some reason to think that will still be the case. This June saw sales that were still 20 percent higher than in June 2019, according to the NSSF’s analysis. Additionally, there are reasons to think June’s recent decline was partly driven by some factors that made June 2022 a particularly good year for sales.

For one, it was an election year, and gun sales are often driven in part by at least the perception there could be new restrictions placed on who can own which guns. Unlike 2022, or 2020 for that matter, 2023 is not an election year. And, in the same vein, June 2022 actually saw a new federal gun-control law pass.

The Bipartisan Safer Communities Act did not introduce new blanket bans on guns, and it only expanded the list of people prohibited from owning guns to those convicted of misdemeanor crimes of violence against their dating partners. So, the direct impact on the vast majority of Americans was somewhat limited. But it was still the first new gun restriction to make it into federal law in a generation, and it foreshadowed the push for a new “assault weapons” ban that successfully made it through the House the next month (though not to President Joe Biden’s desk.)

June 2023 had no such threat of new federal gun restrictions hanging over it. In fact, President Biden’s efforts to implement new bans unilaterally increasingly faltered during the first half of 2023. So, whatever motivation politics provided during the previous June were gone this year.

Further evidence June 2023 was a bit of an outlier can be seen in the numbers for the entire quarter. It saw a less dramatic decline in gun sales from the previous year, and those levels were nearly 30 percent higher than the same period in 2019.

Still, they both showed a continued decline. And a 20 percent drop year-over-year in June is enough to justify some new scrutiny of where the market is headed. After all, 2016 through 2019 were viewed as bad years for the gun industry. They were commonly referred to as the “Trump slump” because sales stagnated after seeing continuous growth during the Obama Administration.

It’s unlikely we’ll see an industry recession anytime soon. Gun and ammo companies certainly ramped up production during the pandemic to try and meet demand. But many did so fairly cautiously because they understood the boom and bust cycle of gun sales.

“We just built a new factory 18 months ago, which we moved into and more than doubled our space,” Jason Hornady, vice president of Hornady Manufacturing Company, told The Reload back in May 2021. “We’re very rapidly filling the space we have. We were doing that whether there was an election, a pandemic, or a riot. We were already planning to grow.”

But Hornady, whose company has more than 500 employees, limited expansion because he said he understands the risk involved with betting peaks are new floors.

“I remember my father having to lay people off as a young person,” he said. “And that is something I don’t want to do. I want to keep everybody busy as long as we can. That’s important to us.”

But, if sales fall all the way back to pre-2020 levels, it will be difficult to avoid some shrinkage. And it will be a disappointing situation for the industry and gun-rights activists alike because it will signal that something has gone wrong with those millions of new gun owners. After all, if your customer base suddenly expands but can’t sustain the sales you saw before the spike, the new gun owners either didn’t stick around for long or aren’t as interested in buying new ones as the ones who anchored the market beforehand.

Since June tends to mark the low point of the seasonal sales cycle for guns, the numbers will likely rise month-over-month through the rest of the year. But the key metrics to watch will be the year-over-year performance. Will July 2023 be down 20 percent over July 2022? Will the third quarter be more than 6.7 percent down from last year?

Those are the key questions that remain to be seen.

There are reasons to think an upswing could come. The 2024 elections are still over a year away, but the primaries are going to start heating up this fall, and President Biden is pushing as hard as ever for new gun restrictions. Deep blue states are also continually pushing the boundaries with their own efforts to restrict gun ownership and carry.

But the election does remain a ways off and the post-pandemic era is becoming more post than pandemic as the days go by. There isn’t the same level of chaos that existed just a few short years ago. The murder rate even seems to be receding. Americans may feel less and less urgency to go out and buy a gun for self-protection, which is what people tell pollsters is their top reason for owning guns.

We’ve been looking for a new normal since all-time records stopped being set in 2021, and it seems the market hasn’t found it yet. When will it?

Only Members can view comments. Become a member today to join the conversation.