The rising tide of gun sales has begun to recede.

That’s the indication from the latest sales figures for one of the country’s largest gun makers. Ruger reported sales dropped nearly $60 million in the second quarter compared to 2021. The company said the drop was the result of lower demand for guns.

“Consumer demand for firearms has subsided from the unprecedented levels of the surge that began early in 2020 and remained for most of 2021, resulting in a 30% reduction in our sales from the second quarter of 2021, which was the highest quarter in sales and profitability in our history,” Christopher J. Killoy, Ruger CEO, said in a statement.

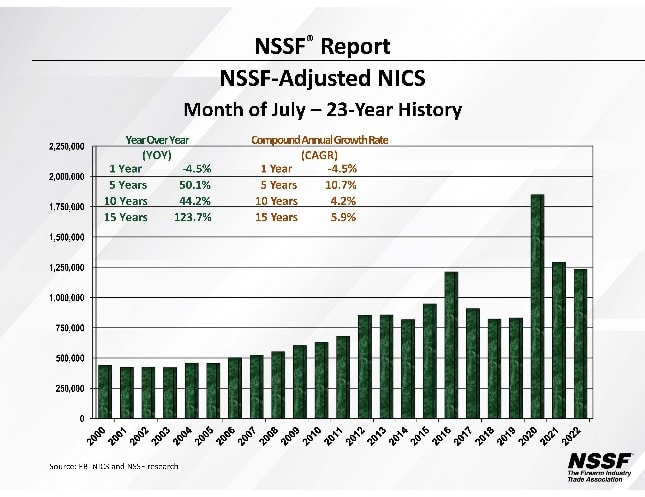

The numbers are in line with the National Shooting Sports Foundation’s analysis of gun background checks for July, which found 2022 saw the third most ever but also amounted to a substantial decline from the two previous years. The signs point to a market still searching for a new bottom. The rate of decline has slowed significantly, though, and sales remain well above historical norms.

The past two years have produced the strongest sales on record across the industry. March 2020 saw more gun-sales background checks than any month on record, and 2020 saw the most of any year. Major brands rode the increased sales to record profits in 2021. Smith & Wesson also achieved the first billion-dollar sales year of any gun company on record.

Ruger’s sales fell from over $200 million in Q2 of 2021 to $140 million in 2022. Diluted earnings fell from $2.50 per share to $1.17 per share.

The first six months of the year saw a similar decline. Sales dropped from over $384 million in 2021 to $307 million in 2022. Diluted earnings fell from $4.66 per share to $2.87 per share.

Killoy said the brand also saw a decline in its profit margins as well.

“Our profitability declined in the second quarter of 2022 from the second quarter of 2021 as our gross margin decreased from 39% to 31%,” he said. “In addition to unfavorable deleveraging of fixed costs resulting from decreased production and sales, inflationary cost increases in materials, commodities, services, energy, fuel and transportation, partially offset by increased pricing, resulted in the lower margin.”

Still, Killoy said the decline does not threaten Ruger’s business, and the company remains low on some stock.

“Yet our broad and diverse product family helps us weather fluctuations in demand as we adjust production accordingly,” he said. “While channel inventory of some of our product families, including certain polymer pistols and modern sporting rifles, have been largely replenished, inventories of other product families remain below desired levels.”

Killoy said the company’s new products were a bright spot, though. Sales of the PC Charger, MAX-9 pistol, LCP MAX pistol, and Marlin 1895 lever-action rifles made up 11 percent of Ruger’s total sales.