This week, we got some new insight into the lobbying fight over guns.

What’s more interesting than the gun-rights groups outspending the gun-control groups–it is a Republican trifecta in DC after all–is the ranking among the former. The industry is now the clear leader on The Hill. Contributing Writer Jake Fogleman graphs out the path from 2016 to today, which shows both the decline of the NRA and the rise of the NSSF.

Then, I take a look at the one real bright spot for gun dealers in the current market: Colorado. Governor Jared Polis (D.) just signed onerous new gun restrictions into law, and residents are flocking to their local gun store. FBI numbers show the last two months are unlike anything the state’s gun dealers have seen since the onset of the COVID-19 Pandemic.

Plus, Black Basin Outdoors explains what ammo market data is saying about Trump’s tariffs on the podcast.

Analysis: Charting the Industry’s Gun Policy Lobbying Rise [Member Exclusive]

By Jake Fogleman

Under the second Trump administration, the forces at work hoping to influence and shape American gun policy haven’t changed much, but one has risen above the pack.

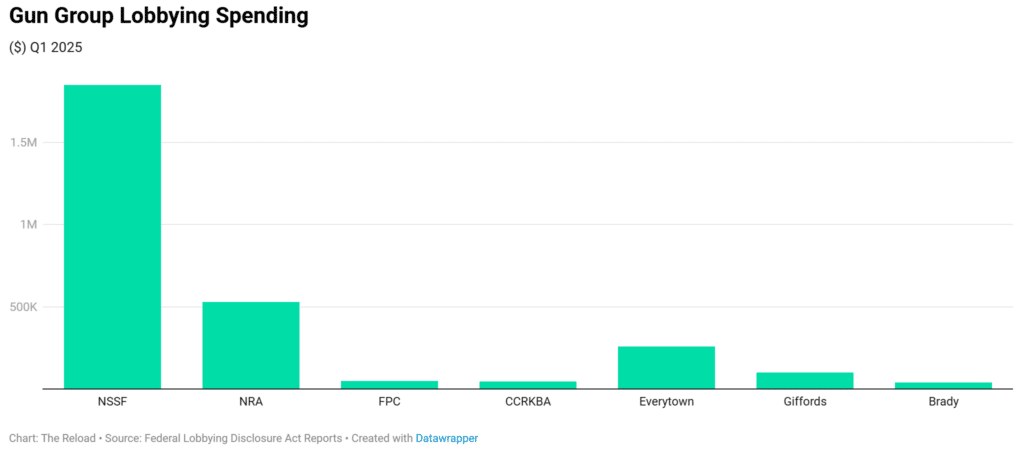

The National Shooting Sports Foundation (NSSF), the firearms industry’s trade association, has emerged as the dominant gun lobbying force. Aided in part by a boost in its own output as well as the diminishment of the country’s former top-dog, the National Rifle Association (NRA), the NSSF is currently spending more on federal lobbying than all of the other gun groups (on either side of the issue) combined.

First quarter Lobbying Disclosure Act filings show the group has already spent $1,850,000 attempting to influence the recently minted federal Republican trifecta. By contrast, the NRA, Firearms Policy Coalition (FPC), and Citizens Committee for the Right to Keep and Bear Arms (CCRKBA) spent $626,904 put together over the same period. Meanwhile, the major gun-control groups—Everytown, Giffords, and Brady—collectively spent just $400,000.

The early numbers tell a story of substantial disparities in both enthusiasm and capacity between the major gun groups.

The first quarter of an inaugural year covers a good deal of the President’s first 100 days in office, a time generally marked by an administration and Congress aggressively pushing to establish their preferred policy agenda before external forces have as much sway over the business of the day. President Trump ran for re-election on promises to gun-rights advocates to enact a series of pro-gun reforms. Though the major gun-control groups outspent gun-rights groups leading up to the election, Trump’s victory, and that of enough like-minded lawmakers in both chambers of Congress to secure Republican majorities, chilled the influence of groups like Everytown and Giffords.

The gap in spending on the gun-rights side is a different story. Groups like FPC and the CCRKBA have never had much of a federal lobbying presence, at least not to the degree of groups like the NRA and NSSF. The disclosures for other significant players like Gun Owners of America and the National Association for Gun Rights, which typically report spending hundreds of thousands in lobbying per quarter, haven’t been made public yet.

So, data for the gun-rights groups is incomplete.

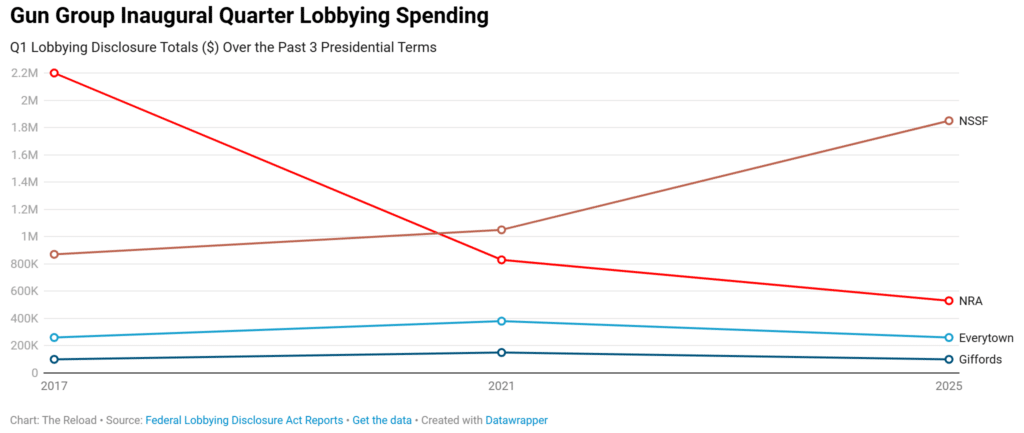

What is clear, though, is how much the NSSF has supplanted the NRA as the gun-rights movement’s top lobbying presence. One needs only go back to the last time Republicans swept into federal power to see how much their roles have reversed.

After being an early endorser of Trump and spending tens of millions to help get him elected in 2016, the NRA was quick to try to wield its influence on the first-term President and the previous Republican Congress. The NRA reported spending $2.2 million on federal lobbying in the first quarter of 2017, while the NSSF spent $870,000.

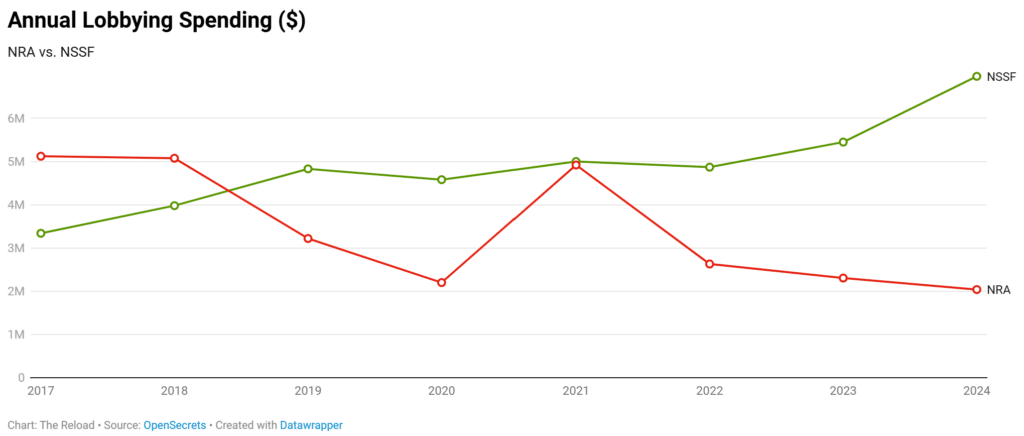

However, following its strong showing at the beginning of Trump’s first term, the NRA’s lobbying presence began to diminish–at least in terms of dollars spent. The NSSF, meanwhile, ramped up its lobbying spend.

Over that time, the NRA has seen both its financial and political capital wane amidst years of public turmoil over financial malfeasance by its former leadership and a series of costly and high-profile legal battles stemming from it. That has allowed the NSSF to cement itself, at least for the time being, as the biggest political gun force in Washington, DC.

What comes from this newfound clout for the NSSF remains to be seen. The Trump administration has been slow to roll out concrete gun policy changes thus far. But the plans and reviews it has announced, which NSSF reported lobbying on, could eventually bear fruit.

Its influence appeared to pay off early on in the administration when the Commerce Department suddenly froze all firearm export licensing, only to later reverse course after meeting with the NSSF. However, it does not appear to be enough to ward off other, non-gun-specific policies that stand to damage the industry, such as the Trump administration’s tariff policy.

Future quarterly reports and ongoing policy fights will ultimately tell the influence tale. What is clear now, though, is the NSSF has surpassed the NRA–and everyone else–as the biggest spender inside the halls of Capitol Hill.

Podcast: What Ammo Market Data Says About Tariff Impacts So Far (ft. Black Basin Outdoors) [Member Early Access]

By Stephen Gutowski

This week, we’re starting to see the effects of President Trump’s tariffs on the ammo market.

To discuss the real-world pricing data we have Nathaniel Boos of Black Basin Outdoors on the show. Black Basin is an online ammo dealer, but it also publishes the most comprehensive pricing data on the internet. From that data Boos said we can already seen some signs of what’s happening.

And the results are interesting.

For the most popular rounds, such as 9mm or 5.56 NATO, prices haven’t moved very much overall. But under that steady stream are some fascinating undercurrents. As imports have become more expensive under the 10 percent tariff, American brands have largely chosen to reduce prices in an effort to retake marketshare–something that’s evened pricing out in most sectors.

However, Boos said Black Basin has already seen some overseas suppliers simply stop shipping product into the US. He said part of the reason prices haven’t shot up across the board yet is that the market has a glut of supply following the 2024 election. He warned prices could increase once supply dwindles and demand picks back up, likely in the Fall.

Boos argued the tariffs could end up limiting consumer options and pushing up prices over time, even eliminating supply of some less popular rounds. But in the short term, they’ve helped American ammo makers recapture market share while imposing little monetary pain on consumers–an outcome tariff supporters are aiming at.

You can listen to the show on your favorite podcasting app or by clicking here. Video of the episode is available on our YouTube channel. An auto-generated transcript is available here. Reload Members get access on Sunday, as always. Everyone else can listen on Monday.

Plus, Contributing Writer Jake Fogleman and I unpack federal lobbying data from the first quarter of 2025, which shows that gun-rights groups have been far outspending gun-control advocates on the Hill. We also cover new monthly gun sales data showing a continued slump for the industry. Finally, we discuss a new gun industry liability shield signed into law in Tennessee before wrapping up with some stories from outside The Reload.

Analysis: Colorado Gun Sales Surge After Polis Signs Sweeping New Restrictions [Member Exclusive]

By Stephen Gutowski

Gun sales are slumping across the country, but one state is bucking that trend: Colorado.

Gun-related National Instant Criminal Background Check System (NICS) checks were down by 3.4 percent year-over-year across the country in April, according to the National Shooting Sports Foundation (NSSF). Over the same period, however, detailed FBI records show they were up by 15.3 percent in the Centennial State. Despite ranking 21st by population size, Colorado also managed to crack NSSF’s top five in gun sales during the month.

Of course, the reason why isn’t likely to lift spirits in the gun industry. The surge in sales corresponds with Governor Jared Polis (D.) signing a sweeping new permit-to-purchase law.

The “Semiautomatic Firearms & Rapid-Fire Devices” bill criminalizes the manufacture, distribution, transfer, and purchase of any semi-automatic rifle, shotgun, or “gas-operated” handgun that accepts a detachable magazine. But it also includes an exception for those who undergo an extensive training and permitting process. It will add significant time and cost to the process of buying many of the most popular firearms for the average state resident.

“This legislation builds on our commitment to improve public safety, reduce gun violence, uphold our freedom,” Polis said of the law in a statement.

Gun-rights activists disagreed. They argue the new restrictions violate the Second Amendment and have vowed to sue.

“We are resolute in our response,” Ray Elliott, Colorado State Shooting Association president, said. “The Colorado State Shooting Association is actively exploring every legal option to challenge this unconstitutional law. Our legal team is preparing to contest Senate Bill 3, and we are committed to pursuing justice through every available avenue.”

In addition to the legal uncertainty surrounding the law, there are still many practical questions Colorado officials will have to answer in the coming months. The permitting process and even the specific guns the state will apply the permitting requirement to haven’t been determined yet. The law’s full provisions won’t go into effect until August of next year.

Colorado gun owners seem to be taking that time to stock up. While national NICS numbers have fallen all year, Colorado’s have been ramping up. January saw a modest five percent year-over-year increase, but the gap between Colorado gun-related checks and the rest of the country has only widened since then. February saw 12.7 percent growth. March experienced a 42.3 percent jump as the details of the proposal, which started as a total sales ban, came into focus.

Combining the handgun, long gun, and “other” categories in the NICS report for April 2025 indicates the FBI conducted 43,389 checks during that month. Outside of March 2025, that means April saw the most sales-related NICS checks going all the way back to 2023.

Meanwhile, the number of sales-related NICS checks in March 2025 was all the way up at 55,374. That makes it the best month Colorado has seen in a half-decade. It is the most since March 2020, during the onset of the COVID-19 pandemic. That month saw the most NICS checks of any month in history.

The impact of Colorado’s permit-to-purchase law on stoking gun demand is apparent.

Whether it will motivate Coloradians to turn out at the polls against Polis and his party the way they have at their local gun stores isn’t apparent. Democrats faced a huge grassroots backlash after they passed a magazine ban in 2013. Opponents managed to successfully recall a state senator for the first time in history as a result.

But Colorado’s politics have continued to shift left nonetheless, including its gun politics. Democrats have more than recovered from the recall and have a tighter grip on the levers of state power. They’ve even framed the permit-to-purchase law as a kind of extension of that initial magazine ban, suggesting they don’t expect a similar backlash this time around. Republicans and gun-rights activists will be counting on that backlash to show up again.

That’s it for now.

I’ll talk to you all again soon.

Thank you,

Stephen Gutowski

Founder

The Reload