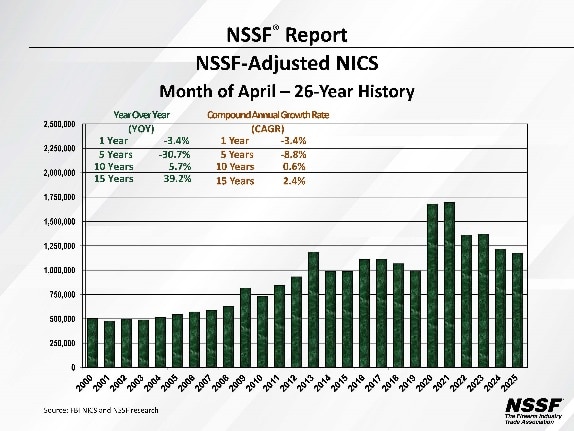

The number of FBI background checks associated with gun sales fell again last month, according to a new industry report.

On Friday, the National Shooting Sports Foundation (NSSF) said sales-related checks fell by 3.4 percent year-over-year in April. That continues the gun market’s downward trend over the course of 2025, with sales also falling in March and the first quarter as a whole. NSSF estimated the number of National Instant Criminal Background Check System (NICS) checks fell from over 1.2 million in April 2024 to about 1.175 million last month.

That makes April 2025 the worst-performing April since 2019, putting it close to the pre-pandemic sales baseline.

The declining sales come as the gun industry is facing two major headwinds. The first is political, with the election of industry-ally President Donald Trump reducing demand driven by concerns over potential new national gun restrictions. The second is economic, with President Trump’s tariffs likely to hit consumers and companies hard.

While the gun industry features numerous American brands that still produce their products at home, imports make up a sizeable portion of the market as well. American companies made 171,810,319 guns between 2000 and 2023, according to the ATF. However, the same report shows Americans imported 93,335,557 guns over the same period. Another ATF report estimated 26 billion rounds of ammunition had been imported between 2010 and 2020 alone.

“The long-term impact of the tariffs is very fuzzy,” Anthony Welsch, a Lucky Gunner spokesman, told The Reload shortly after Trump announced the tariffs. “Our purchasing team has good relationships with importers and foreign manufacturers. Many of them believe price increases are coming soon. However, it’s very difficult to pinpoint exactly what the increases will be.”

Ben Beauchemin, the owner of Wicked Weaponry, said he worries about what’s coming.

“With everything’s going on, we are waiting with bated breath just to see what’s going to happen,” he told The Reload. “We’re not exactly sure how that’s going to trickle down to us, but at least I know our aluminum products went up–in some cases by about five or ten percent. It’s tough to tell what the cause of that was, but everything is creeping up.”

Ruger, one of the two publicly traded American gun manufacturers, released their latest quarterly earnings report last week. Its numbers track closely with the NICS report. Although, the brand managed to fare a bit better than the overall market. Ruger’s net sales dropped just $1.1 million year-over-year to $135.7 million in the most recent quarter.

“The challenges in the firearms market are clear and well-documented across the industry,” Todd W. Seyfert, the company’s CEO, said in a statement. “According to RetailBI’s Q1 2025 report, retail firearm unit sales declined 9.6% year-over-year, with revenue down 11.5%. Handguns, rifles, and shotguns were all under pressure, and even adjusted NICS checks declined by 4.2%. Despite these 2 headwinds, I’m proud to report that Ruger remained flat in sales, while staying profitable.”

Ruger’s stock has taken a beating since the election, falling nearly 20 percent. Still, it actually performed better than its publicly traded competition, with Smith & Wesson investors losing 30 percent during the same period.

“That resilience is a direct result of our disciplined operations and strong new product pipeline,” Seyfert said. “Consumer demand for the Ruger American Rifle Generation II, our Marlin lever-action rifles, and the RXM pistol developed with Magpul Industries contributed to our momentum. These products not only reinforce our commitment to quality but also continue to excite our loyal base, drive demand and elevate the entire portfolio of Ruger products.”

The NSSF report on gun-related background checks wasn’t all bad news. Sales remained elevated over the long term. April 2025 sales were up 39.2 percent compared to 2010.

Colorado saw a significant increase in checks, too. While it only ranks 21st in population, it was 5th in sales-related NICS checks during April. That’s likely a reaction to the sweeping new permit-to-purchase law signed into law during the same time frame.

NSSF spokesman Mark Oliva noted the group’s numbers indicate sales were still well above 1 million per month. He also argued the moves the Trump Administration is making on gun policy would benefit gun owners in the long term.

“Firearm ownership continues to be a priority for law-abiding citizens,” he said in a statement. “The proof of that is over 1.2 million times in April, Americans freely approached the counter at their local firearm retailer to take lawful ownership of a firearm. These gun buyers did so with a commitment by the Trump administration that their Second Amendment rights would be protected and they wouldn’t be ostracized by their government for exercising rights protected by the U.S. Constitution.”

NICS checks do not represent a one-to-one measure of gun sales. However, they are widely regarded as the closest analog because licensed gun dealers are required to perform them on all customer sales–regardless of whether they happen in store, online, or at a gun show–and only licensed dealers can sell new guns. Plus, 20 states also require people selling their personal firearms on the used market to process those transactions through licensed dealers to ensure a NICS check is done on the buyer.

However, some states also allow those with some permits, like concealed carry licenses, to bypass a NICS check at the point of purchase since they require one during the permitting process. 30 states also don’t require NICS checks on used gun sales between private parties.

Additionally, the FBI’s raw report of NICS checks includes many that aren’t related to gun sales. In fact, some states will run all of their gun-carry permit holders through a new NICS check each month–adding hundreds of thousands of checks to the total. So, NSSF uses the FBI’s coding of NICS checks to weed out those that aren’t related to gun sales. That makes the NSSF’s adjusted estimate a better gauge of how many gun sales there have been in a given period.