Happy New Year!

I hope you and yours had a great 2022. I wish you an even better 2023!

Last year was a monumental year for guns in America as we discussed earlier this week. There’s good reason to think next year will feature just as many developments, though, hopefully, fewer tragedies. On that front, Contributing Writer Jake Fogleman takes a look ahead and lets us know what we should be watching for in gun politics, policy, and litigation this year.

At the same time, I explain why we might see our first Supreme Court intervention in a gun case very early this year. New York and the Court’s collision course is shorter than ever. There’s good reason to think it could come to an end before most people give up on their new year’s resolutions.

There’s no podcast this week. However, we have a bonus piece with deep insight into some new gun sales data. Professor David Blake Johnson, who studies gun distribution at the University of Central Missouri, contributes his first piece and it’s fascinating. He takes a deep dive into newly-released gun sales data out of Massachusetts to explain the patterns that provide new information on how and why Americans buy guns.

Analysis: Supreme Court’s Second Round with New York May Come Soon [Member Exclusive]

By Stephen Gutowski

The Supreme Court and New York are on an accelerating collision course.

Ever since the Court struck down the state’s “may-issue” gun-carry permitting law, which allowed officials to subjectively deny applicants in a way that violates the Second Amendment, lawmakers seem to have been pining for a rematch. After New York State Rifle and Pistol Association v. Bruen was handed down, they went straight to crafting a new batch of gun-carry restrictions. Those included a bevy of novel bans that seem almost purposefully designed to defy the Court’s decree.

“With this action, New York has sent a message to the rest of the country that we will not stand idly by and let the Supreme Court reverse years of sensible gun regulations,” Lieutenant Governor Antonio Delgado (D.) said in a statement after the bill’s passage.

While the state did not try to revive the invalidated standard for issuing permits that left it up to officials to decide whether an applicant had “proper cause” to carry a gun, nearly always finding they didn’t, it doubled down on a similar standard that leaves it up to officials to decide whether an applicant has a “good moral character.” New York also ignored the Court’s rejection of its argument that it could restrict gun carry in a myriad of “sensitive places” and instead added provisions that make it impossible to carry in most publicly-accessible areas. It also added new training requirements that go beyond what all other states have instituted to this point.

Now New York lawmakers may be getting the showdown they wished for. On Tuesday, Justice Sonya Sotomayor ordered the state to respond to an emergency motion by Gun Owners of America to rescind the stay issued by the Second Circuit on a lower court’s ruling in Antonyuk v. Nigrelli that blocked the law. The state has until January 3rd, 2023, to respond.

A mere six months after it decided Bruen, the Court is already dipping its toe back into the water.

That doesn’t necessarily mean the Court is about to cannonball back into Second Amendment litigation. In fact, Sotomayor could decide things herself. Given her opposition to Bruen, she’d likely side with New York on the stay. In that case, we’d learn little about what SCOTUS thinks of the law, and it would probably take several months (or even years) of litigation before the case made its way back to the Supreme Court.

But, if Sotomayor refers the decision to the full Court, it would likely discard the stay. That wouldn’t necessarily amount to a ruling on the merits. But it would give a lot of insight even if the Court doesn’t write anything at all explaining its decision.

After all, if the Court determines that the state’s restrictions are so burdensome on New Yorkers’ exercising their gun rights and removes the stay on the lower court decision to block most of them, it won’t be necessary to read tea leaves on where the case is ultimately headed. The Second Circuit could still defy the Court’s obvious intentions, and the Court may want the appellate court to further develop the record before issuing a detailed explanation of why it can’t stand.

But the outcome will doubtlessly be the same: New York’s most controversial restrictions won’t survive scrutiny.

The situation is starting to look like one of the most overlooked Second Amendment cases in Supreme Court history: 2016’s Caetano v. Massachusetts.

In that case, the Massachusetts Supreme Court upheld a state law banning stun guns because they didn’t exist at the time of the founding and aren’t useful for military service. This, the Court ruled, was a direct contradiction to what the High Court ruled in 2008’s Heller and 2010’s McDonald. Those cases established the Second Amendment protected both modern arms and non-military arms.

Caetano was a Per Curiam order. The Court considered the facts clear enough that it wrote only a few paragraphs noting its own previous rulings, and not one of the four liberal members on the Court at the time wrote a dissent.

Antonyuk may end up the same way. The Court already ruled in Bruen that subjective standards for gun-carry permits are unconstitutional, and the state can’t simply declare most everything a “sensitive place” as a workaround to try and ban lawful gun carry. Antonyuk offers the opportunity to dig into the various new restrictions if the Court wants. But it’s also set up well to give the justices an easy vacate-and-remand path if the Second Circuit upholds the limits.

It’s important to note, though, that very little post-Bruen litigation has made it past the district court stage at this point. The Court has been infamously slow to expand the Second Amendment caselaw to this point.

It has only been six months since Bruen. The justices didn’t rule in Caetano until six years after McDonald. The Court didn’t rule on the merits of another gun case for six years after Caetano either.

But there is good reason to think the era of slow Supreme Court action on Second Amendment litigation is over.

The balance of the Court has shifted since it began examining Second Amendment protections in 2008. After former President Donald Trump (R.) appointed Amy Coney Barrett to replace Ruth Bader Ginsburg in late 2020, the Court moved from five ostensibly pro-gun votes to six.

It’s still early, but the move has seemed to immediately affect how the Court approaches gun cases. In 2019, the Court took up a relatively minor gun case in New York State Rifle and Pistol Association v. City of New York. The case dealt with a novel law banning the transportation of unloaded guns to most locations, but the Court ruled it moot in early 2020 after the city repealed it to avoid losing.

However, instead of waiting for another five or six years to take another case, the Court went right back to the well. And, instead of picking another case dealing with a law on the fringes, it picked Bruen–a case on one of the most contentious gun issues.

Then it issued a landmark decision finding public gun-carry is protected by the Second Amendment and, even more consequentially, establishing a tough test for all future gun cases. That’s reason enough to think the Court may not be willing to wait very long to jump back into the deep end, especially when it comes to laws purpose designed to defy its judgments.

Analysis: What Massachusetts Gun Sales Data Tells Us About How and Why Americans Buy Guns

By David Blake Johnson

Since the mass shooting at Robb Elementary School in Uvalde, Texas, and the proposed “assault weapons” ban passed by the US House of Representatives earlier this year, gun researchers have noted a substantial increase in gun sales.

While not particularly well-known outside of the gun community, this phenomenon (what economists would call a “demand shock”) is common. These shocks are not limited to national tragedies and are observed during other significant events (e.g., legislation and political campaigns).

There is a problem with identifying these shocks stemming from the lack of detailed data regarding changes in gun prevalence. While the Federal Bureau of Investigation (FBI) publishes National Instant Criminal Background Check (NICS) counts that provide insight into sales by state, month, and type, the public information is only available at the state and national levels. It is also less than ideal when it comes to firearm type, differentiating only by handgun and long gun. Stated differently, the best information this data can provide is the number of background checks for a specific gun type (e.g., handgun) conducted in a given state in a given month of a specific year.

For a more detailed look at the short-run fluctuations of gun sales, we turn instead to firearm transaction-level data from Massachusetts. This data was originally obtained through a Freedom of Information Act request sent in the Summer of 2022. Shortly thereafter, the data was made public–coming from the Massachusetts electronic license check system. This data exists due to state law requiring all transfers (e.g., sales, inheritance, etc.) to be reported to the Department of Criminal Justice Information Services Firearms Records Bureau. Sales also require a Firearms Identification Card. Since 2015, the state also requires all transfers to be submitted online.

The public data is semi-anonymized; detailed information about the seller, if the transfer is through a licensed dealer, is included and all information about the buyer is omitted. The existence of this data is controversial and consequently very rare. With it, researchers are given a detailed window into the firearm market and can rigorously explore topics that would be impossible to do so otherwise. Others note that this database effectively serves as a gun registration, which is why similar information collected by the FBI is destroyed, and potentially lead to incorrect policy conclusions due to the database including only legal transfers.

The main advantage of the Massachusetts data set is that it is much finer than the FBI data and contains information about what firearms were sold (e.g., Ruger Mini-14, Browning Hi-Power, etc.), the date of the sale, and where the firearm was purchased (e.g., Bass Pro, Walmart, etc.). This is much more detailed information when compared to the NICS data. Not only does it include completed transactions, rather than checks that might not result in a sale, but it also provides what exact firearms were sold, on what specific date, and where the firearms were sold.

While Massachusetts’s liberal gun-control policy certainly affects firearm sales, the demand shocks caused by national events are still present in this data. However, it must be emphasized this data only reflects transactions taking place at licensed dealers. Therefore, extrapolation to national trends or the gun market, in general, must be taken with some caution. Whether these shocks are more apparent when including private transactions or are greater in other states with different gun laws is an open question.

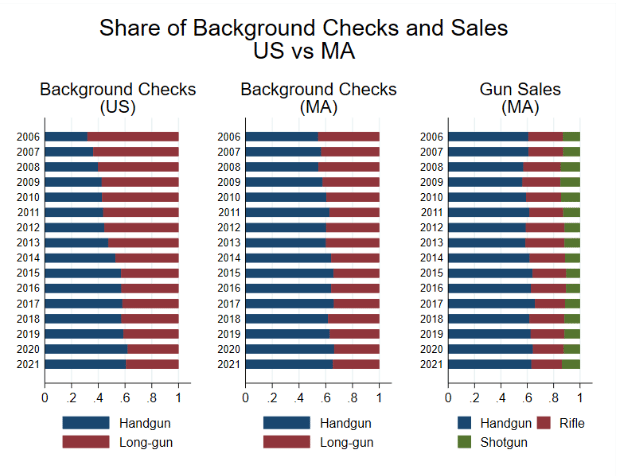

We start with a basic comparison of the NICS and transaction data – with the latter being aggregated in a way to make the datasets comparable. Overall, the firearm sales data from Massachusetts matches the Massachusetts background check numbers reported by the FBI. The share of handgun and long gun sales match NICS checks, but the correlation between the number of background checks and total monthly sales is .98–verifying the accuracy of the sales data.

Interestingly, when comparing the background checks in Massachusetts to national figures, Massachusetts is not representative of the United States. While the United States is moving in the direction of Massachusetts (exhibited by a growing share of checks involving handguns), historically checks involving long guns (rifles and shotguns) tended to be more common than background checks involving handguns. This was not the case in Massachusetts which has historically seen handguns make up about 60 percent of dealer sales.

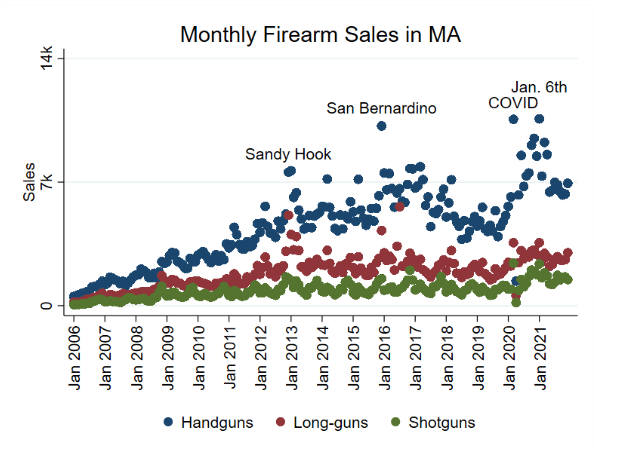

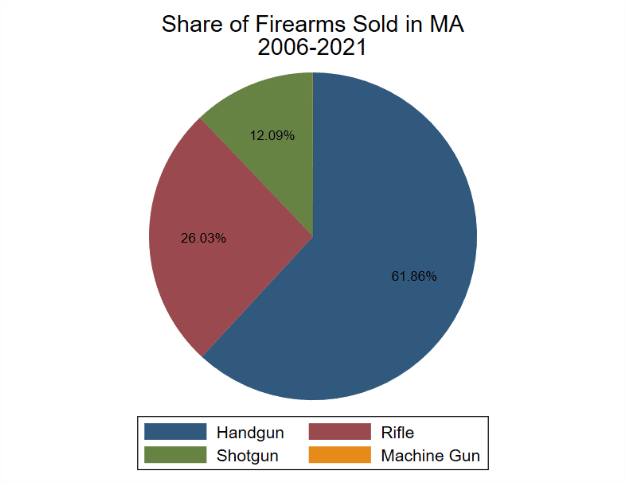

From 2006 to 2021, nearly 1.4 million firearms were sold/transferred by licensed dealers in Massachusetts. In 2006, 17,125 guns were sold (10,410 handguns, 5 machine guns, 4,500 rifles, and 2,210 shotguns). By 2021, this had increased to 140,229 guns (88,578 handguns, 11 machine guns, 32,463 rifles, and 19,177 shotguns). That comes out to about 8,000 more guns sold per year on average.

However, there is a lot of variation. Broadly speaking, sales increases tended to be the largest in the years prior to the 2016 election and the second half of former president Donald Trump’s term. In between those periods, sales fell and remained muted.

There were also short-run fluctuations during that time. Significant spikes corresponded with major news events. Notably, clear spikes occurred in the aftermath of the Sandy Hook and San Bernardino massacres. There are multiple reasons for these runs. Arguably, the three most commonly cited ones are fear of new gun control legislation that would prevent a future purchase, protest purchases against proposed legislation, and individual concerns for safety.

However, attributing sales spikes to specific events is often more complicated than one might expect as eye-catching events often occur in rapid succession.

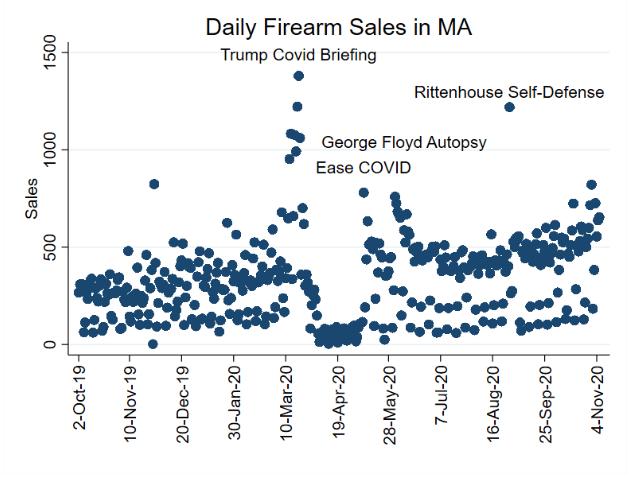

To illustrate, consider 2020. Firearm sales spiked on March 20, 2020, after former President Donald Trump’s COVID-19 announcement, and plummeted during the shutdowns occurring soon after the announcement. Gun sales spiked once these restrictions were lifted but quickly fell suggesting the rise in firearm sales was not a typical increase in demand but rather pent-up demand being resolved.

This drop was very temporary as sales increased once again in the wake of George Floyd’s murder. Sales quickly fell again then continued an upward trend towards the end of 2020. But another notable spike corresponded with the announcement of Kyle Rittenhouse’s self-defense plea after he shot Joseph Rosenbaum and Anthony Huber during rioting in Kenosha, Wisconsin.

But not all gun sales were equally impacted by national events. Handgun sales seemed to be the most influenced by highly publicized events while shotguns had consistent sales growth with little variation. Rifle sales fell somewhere in the middle. Rifle sales were dominated by the Smith & Wesson M&P15 (an AR-15 style rifle) and the Ruger 10/22 (often considered a starter rifle), which are generally less responsive to events than handguns.

High-profile mass shootings are a notable exception. Curiously, not every mass shooting translated to increased rifle sales–suggesting some level of satiated demand. This is particularly the case with mass shootings occurring soon after a different shooting or some other national event (e.g., new legislation).

Overall, the Massachusetts firearm transaction data show firearm sales increased alongside population growth. Sales also often spike in the run-up to national elections or the aftermath of a national news event that drives people to look for ways to protect themselves, such as riots or mass shootings. The shocks caused by those events are seen over and over again, but they only last a short time.

Analysis: What to Expect on Guns in 2023 [Member Exclusive]

By Jake Fogleman

2022 was a watershed year for gun politics in America.

The U.S. Supreme Court heard and decided its first consequential Second Amendment case in over a decade and recognized for the first time a right to carry a firearm in public for self-defense. It also finally established the specific legal test lower courts must use when reviewing gun cases, a text and history-based standard that many gun-rights advocates hope can be used to overturn restrictive modern gun laws.

At the same, horrific mass shootings like the one at an elementary school in Uvalde, Texas, created a sudden groundswell of support for new gun laws midway through the year. That ultimately led to the passage of the first federal gun restrictions in nearly three decades, with bipartisan support.

Both sides of the American gun debate achieved significant victories in 2022 and will be looking to capitalize on that momentum in the new year. Here’s a look at what to expect on guns in 2023.

Second Amendment Litigation

The Supreme Court’s ruling in New York State Rifle & Pistol Association v. Bruen opened the floodgates on legal challenges to all kinds of gun restrictions. Animated by the Court’s new test for gun cases, gun-rights groups filed a bevy of lawsuits across the country in 2022. Expect that trend to continue in 2023.

While it would be nearly impossible to document the several dozen cases expected to arise in the new year, there are certainly some big ones to watch. Those include the ongoing challenges to New York and New Jersey’s Bruen-response bills. The resolution of those cases will determine how far states can push the limits of the Supreme Court’s holding in Bruen. That will impact the residents of each respective state who hope to carry a firearm for self-defense and the expected copycat measure likely coming from California.

The New York cases, in particular, will also test the willingness of the High Court to superintend its own decision. After several injunctions against the New York law were stayed by the Second Circuit, gun-rights advocates filed an emergency request with the Supreme Court to vacate the stays. Justice Sonya Sotomayer, who oversees the Second Circuit, is requiring New York to respond by January 3rd.

How the Court decides to rule in this matter could provide insight into how active it intends to be on gun cases moving forward.

Other significant cases include the ones against Maryland’s assault weapon ban and California’s magazine ban/confiscation law. Both cases were granted, vacated, and remanded by the Supreme Court to be revisited in light of the Bruen decision. The outcome of those challenges will provide test cases for how lower courts previously favorable towards gun bans will respond to the Court’s new test.

Lastly, the state and federal challenges to Oregon’s new gun-control ballot measure will be worth keeping an eye on. The cases could provide the first high-profile test of the legality of permit-to-purchase laws under the Supreme Court’s text and historical tradition standard, an interesting question in light of Justices Kavanaugh and Roberts defending the constitutionality of shall-issue gun-carry permitting in a Bruen concurrence.

State-Level Gun-Control Push

As the Supreme Court’s decision in Bruen has reinvigorated the gun-rights movement’s litigation efforts, so too has it inspired a renewed push among gun-control advocates on the legislative front.

In traditionally blue states, as well as in some purple states where Democrats currently have political control, expect to see a big push for new gun-control laws.

In California, for instance, expect lawmakers to deliver on their promise to reintroduce and pass their Bruen-response bill that failed to get over the finish line in August 2022. That would make California the third state, after New York and New Jersey, to pass a sweeping and restrictive overhaul of its concealed-carry laws as a rebuke of the Supreme Court.

If introduced and passed in the same form as the last bill, it will raise the minimum age to carry from 18 to 21, require at least 16 hours of firearms training, and add a subjective “good character” standard that will require at least three personal references and a social media check. It will also add dozens of new “sensitive areas” where licensed gun owners would not be allowed to carry, including all school grounds, college and university campuses, government and judicial buildings, medical facilities, public transit, public parks, playgrounds, public demonstrations, and any place where alcohol is sold.

In other states, expect things like “assault weapon” bans and red flag laws to get new pushes.

Illinois lawmakers are already debating a gun-control package that would ban the sale and possession of assault weapons, ban magazines capable of holding more than ten rounds, prohibit 18-20-year-olds from purchasing firearms, and extend the state’s “red flag” period from 6 months to one year. The bill was one of Governor J.B. Pritzker’s (D.) legislative promises after winning reelection, and state lawmakers expect to hold a final vote on the legislation in the new year.

Likewise, both the Governor and Attorney General of Washington state have promised to work on getting an assault weapons ban and a permit-to-purchase requirement passed when the state’s legislative session begins in January.

In Colorado, an expansion of the state’s existing red flag law is likely, as is a measure to raise the age to purchase AR-15s and similar rifles. An outright ban on those rifles, as well as unserialized guns, is not off the table either when the state assembly reconvenes in early January.

Newly secured state government trifectas for Democrats in Michigan and Minnesota also present fertile ground for new gun-control laws. Democratic lawmakers in both states have already said that passing red flag laws will be among their top priorities.

And finally, the state of Vermont will be one to watch for possible movement on the state’s preemption law. Many of the state’s cities and towns have been publicly calling for the ability to regulate firearms locally, which is currently prohibited by Vermont’s Sportsman’s Bill of Rights.

Vermont voters just chose to reelect Republican Governor Phil Scott, which makes the prospect of a preemption repeal bill more difficult. But Democrats currently hold veto-proof majorities in the state legislature, so repeal is not unthinkable. If successful, Vermont would become just the second state to ever repeal a firearm preemption law after Colorado in 2021.

ATF Rulemaking

We should finally get clarity on the second of President Biden’s major executive actions on guns early in the new year. In a joint status report from an ongoing lawsuit with the Second Amendment Foundation, the ATF reported that it was pushing back the release of its final pistol brace rule to some time in January of 2023. Originally the rule was supposed to be published by August 2022.

The final text of the rule will be of keen interest to the millions of gun owners who currently possess the popular firearm accessory. If the final rule strictly interprets pistol braces as National Firearms Act (NFA) items, the ATF could turn millions of Americans into felons for simply owning something they lawfully purchased.

An aggressive interpretation of the new rule appears more likely than ever after the ATF sent gun dealers a letter this week expanding its interpretation of what constitutes a regulated firearm frame or receiver to unfinished parts even when sold outside of kits.

Look for these new rules to generate lengthy legal battles as well.

Carry Legislation/Pro-Gun Bills

Carry rights are poised to play a significant role in other states beyond those trying to retaliate against the Supreme Court. Expect the push for permitless carry to continue in the remaining shall-issue states with unified or near-unified Republican control.

That includes Florida, where Governor Ron DeSantis (R.) just won a resounding reelection victory, and Republicans took supermajority control of the state legislature. After voicing support for it in the past, DeSantis is already promising to get a bill across the finish line this upcoming session.

“Basically, this was something that I’ve always supported,” he told the Tampa Bay Times. “The last two years, it was not necessarily a priority for the legislative leadership. But we’ve been talking about it, and [House Speaker Renner (R.)] pledged publicly that’s moving forward, and it’ll be something that will be done in the regular session.”

South Carolina and Nebraska also have a solid shot of joining the move to permitless carry in 2023. In South Carolina, where Republicans hold trifecta control of the state government, a state senator has already introduced a permitless carry bill for consideration when the legislature reconvenes in January.

In Nebraska, a 2022 permitless carry bill narrowly failed in the state’s unicameral legislature after falling just two votes short of overcoming a Democratic filibuster. However, state Republicans made gains in the chamber this November and now have a filibuster-proof majority, clearing the way for a successful reattempt in 2023.

The past year was undoubtedly chock full of significant milestones that moved the needle in American gun politics. It’s already looking like 2023 could be similarly consequential.

That’s it for now.

I’ll talk to you all again soon.

Thanks,

Stephen Gutowski

Founder

The Reload